Payment Gateway vs. Processor: Which One Do You Actually Need?

Introduction: The Confusion Behind the Swipe

In the early days of e-commerce, accepting online payments felt extraordinary. Today, it is a standard expectation. Whether you are tapping on your phone at a coffee shop or clicking “Place Order” on a new pair of sandals, the transaction feels immediate. That instant ‘Approved’ message is only the surface. Behind that split-second confirmation, a high-speed relay occurs between multiple financial entities to ensure your money moves safely from point A to point B.

For business owners, the language of digital finance is a maze of confusion. Two terms- payment gateway and payment processor-are often used as synonyms, yet they both perform different functions in your business. Understanding the difference between a payment gateway and a payment processor is essential because it directly impacts your security, overhead costs, and how easily your business can grow in the future.

In this guide, we will decode payment processor vs payment gateway to help you accurately determine what your business needs to develop.

What is a payment gateway vs a payment processor?

In simple terms, a payment gateway vs. a payment processor can be considered the “Front-end” vs. the “Back-end.” The gateway serves as the digital shop that interacts with the customer, whereas the processor functions as the financial engine that communicates with the banks. Together, they form the foundation of your merchant payment processing system.

To better understand payment processor vs payment gateway, it helps first to know who’s involved behind the scenes of every payment.

- The Customer: The one who initiates the payment through cards, digital wallet, or bank transfer.

- Payment Gateway: It acts as a secure online portal that captures and encrypts the payment details.

- Payment Processor: The engine that routes the transaction between banks and card networks.

- Card Networks: Major players like Visa, Mastercard, and Amex that manage the transaction flow.

- Issuing Bank: The customer’s bank that approves or declines the funds.

- Acquiring Bank: Your business bank account where the funds are ultimately deposited.

While every player is essential, the gateway and processor are the key hub that connect all others. Understanding these two pillars of merchant payment processing is key to reducing transaction costs, ensuring data security, and optimizing your business’s cash flow.

What is a Payment Gateway?

Consider a payment gateway a secure channel for financial data. It makes it easier for data to go from a customer’s payment method—such as a debit card or digital wallet—to the company’s bank account. This platform guarantees immediate verification and encryption of each transaction. The gateway provider usually charges a processing fee for each successful sale in exchange for providing this vital link.

How it Works:

In simple terms, a payment gateway is a virtual point-of-sale system that manages the complexities of online shopping. It handles transactions from start to finish, serving as an in-person terminal and incorporating additional encryption layers to prevent fraud. The payment gateway performs a complex series of encrypted exchanges between banks to enable funds transfer, while the consumer only sees the “checkout” button.

A card reader in a shop takes several steps to process your purchase. Similarly, a payment gateway directs payments via the internet through a series of secured stages:

- Authorization → Fund Verification → Communication between banks to approve the amount.

- Authentication → Fraud Prevention → Verifying the cardholder’s identity (e.g., 3D Secure).

- Clearing → Fund Transfer → Moving money from the customer to the merchant.

What is a Payment Processor?

A payment processor is what makes it possible for a business to be flexible in today’s digital world, an exceptional service that ensures that electronic transactions are safe and secure. It validates that payments from various sources, such as credit cards or digital wallets, are processed quickly and correctly. They handle the safe transfer of funds, which removes the hassle of dealing with banks. This helps the firm remain focused on its clientele rather than on the deal details.

How do Payment Processors work?

A payment processor is essentially the “translator” between a customer’s bank and a merchant’s store. They play a vital role by enabling businesses to embrace the digital age by managing the technicalities of processing various payment types. Without a payment processor, the smooth, quick checkouts that we now expect would not be feasible.

Functions of Payment Processor:

- Transaction Delivery: Sends purchase details between the customer’s bank and the merchant’s bank.

- Approval Check: Verifies with the customer’s bank that sufficient funds are available and confirms the cardholder’s identity.

- Safety & Privacy: Protects sensitive data through encryption and tokenization.

- Fund Settlement: Moves the approved funds from the customer’s account to the business’s account.

- Insights & Records: Maintains a history of all sales, showing trends and total earnings.

- Fraud Prevention: Monitors for suspicious activity and assists in resolving payment disputes.

- Global Reach: Processors allow customers to pay in their local currency, even when shopping with international stores.

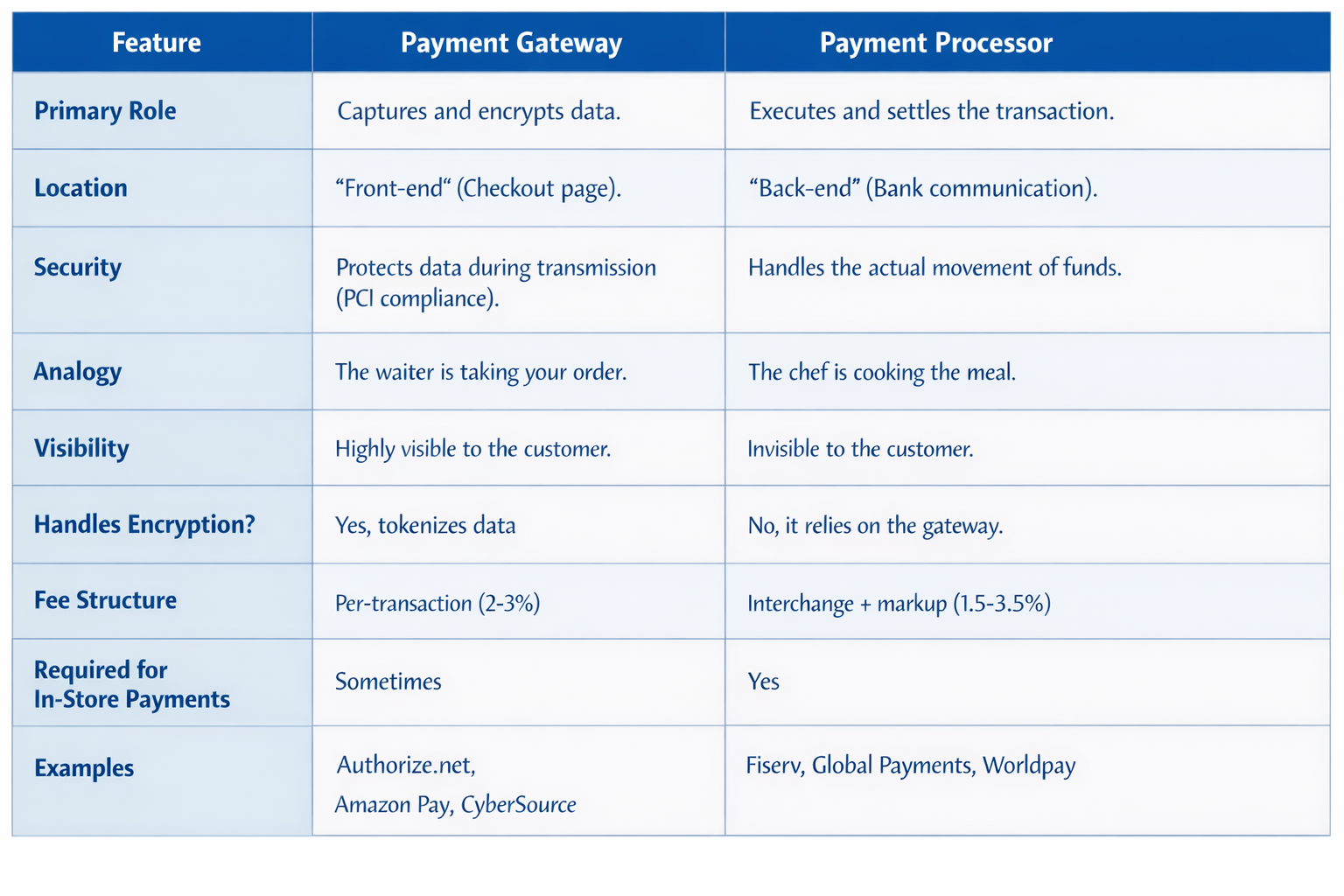

- Comparison Table: Payment gateway vs Payment processor

Do You Need One, the Other, or Both?

For most modern businesses, the choice isn’t “one or the other”—it’s both.

If you are running an e-commerce store, you need a secure portal to collect digital data. Additionally, you need a processor to communicate with the banks and move the money. Data cannot be received without a gateway, and funds cannot be received without a processor.

The industry, however, is evolving. A growing number of fintech innovators, such as Patel Processing, now offer “all-in-one” solutions that incorporate these functions. Instead of managing individual agreements and technical setups for a gateway and a processor, business owners can use a consolidated service. This bundled approach enhances the process, allowing you to manage your entire payment system through a single account with an easy-to-understand, transparent pricing structure.

When might you only need a processor?

If you operate a purely physical business, such as a community hardware shop or a local cafe, you may only need a processor.

As you only swipe or tap physical cards, your credit card terminal manages all the hard work. In these “card-present” circumstances, the device itself controls the security and data gathering. Since the hardware performs as the secure link, a separate digital gateway isn’t necessary. The terminal communicates directly with the processor for payment processing.

When is it necessary to have both?

Online Sales: Any website or mobile application requires a gateway to secure sensitive information before it reaches the processing network.

Omnichannel Retail: Managing both a physical store and an online platform requires a gateway to synchronize online data and a processor to handle transaction volume from both channels.

Subscription Models: To handle repeated charges, businesses utilize gateways to store digital “tokens.” This ensures the processor can bill monthly while providing a seamless customer experience.

Choosing the Right Combo for Your Business

Choosing the correct payment setup is a strategic decision that affects both your profit margins and customer confidence. Patel Processing, for example, is well-known for offering customized merchant services for specialized sectors such as gas stations (petroleum), hotels (hospitality), high-risk markets, and more.

To identify the optimal match, assess these four essential foundations:

Transparent Pricing: Businesses with high volumes should consider interchange-plus pricing to achieve lower, transparent margins. In contrast, smaller startups typically gain from the reliability of fixed-rate pricing. Patel Processing offers Cash Discount Programs and interchange-plus models that help businesses recover fees that would otherwise be charged as processing fees.

Enhanced Security: Choose a provider that uses tokenization to exceed industry-standard security measures. It replaces sensitive card data with secure codes, protecting your business and your customers from potential data breaches.

System Synergy: Make certain your gateway connects seamlessly with your online store and inventory management software. A disconnected system causes checkout difficulties and lost sales.

Reliable Support: Technical issues can hurt your bottom line. Choose a partner known for excellent uptime and 24/7 support to keep your “digital doors” open around the clock.

The Final Verdict

The difference between a payment gateway and a payment processor is fundamentally about communication versus execution. The gateway requests the funds; the processor transfers the funds. For today’s merchant, the question of “which one do I need?” is often resolved by a comprehensive solution. Selecting a provider that manages both aspects minimizes the risk of failures and simplifies your financial reporting. As your company expands into a multi-million dollar enterprise, you can separate these services to reduce your transaction fees by small percentages.

Ultimately, your goal is to make the payment process invisible. When the gateway and processor work seamlessly together, the customer can focus entirely on their new purchase.

FAQs

1. What’s the main difference between a payment gateway and a processor?

The gateway is the digital interface that securely captures and encrypts customer payments. Meanwhile, the processor acts as the engine, facilitating communication between the merchant, banks, and card networks to move the funds.

2. Can I have a payment processor without a gateway?

Yes, but typically only for in-person, ‘card-present’ transactions. When selling online, a gateway is necessary to securely transfer sensitive data from the customer’s browser to the processing network.

3. What is the difference between a merchant account and a processor?

A merchant account is where funds are held during the transaction process, while the processor manages the transfer. Many all-in-one providers now use ‘aggregators,’ which means you can start accepting payments immediately without a dedicated merchant account from a traditional bank.

4. Who pays the fees?

The merchant (the business owner) pays the fees. These typically consist of a percentage of the sale (e.g., 2.9%) plus a flat fee per transaction (e.g., $0.30). The total cost is then split between the gateway, the processor, the card networks, and the banks.

5. Do in-person stores need a payment gateway?

Yes. In-person stores use a gateway as a secure bridge for their data. The gateway takes the information from the card terminal, encrypts it to meet security standards, and sends it to the bank. It keeps your data safe and allows you to see all your sales—online and in-person—in one place.

6. Which one is more expensive?

The processor usually accounts for the largest share of your bill because it handles “interchange fees”. Banks and card networks like Visa and Mastercard set the standard rates.

However, many gateways charge additional fees. Although they don’t handle the actual funds, they may charge a monthly subscription or a small per-transaction fee to protect your customers’ digital data securely.

7. Is a payment gateway the same as a “Buy” button?

The ‘Buy’ button is just the surface. It’s the visual element that tells the website a customer is ready to pay. The gateway is the secure infrastructure that takes over the moment that button is clicked, ensuring the payment information is scrambled and sent safely to the banks.