A Comprehensive Deep Dive into the U.S. Restaurant Point-of-Sale Solutions Market: Unveiling Components, Deployment Modes, and End-User Dynamics.

The USA POS solutions market for restaurants is evolving rapidly at the frontline of technology, and trends have contributed to growth and development. This detailed research blog explains the fundamentals of hardware terminals, the high trend of cloud implementation, and the future advancement of payment processing for various segments. The present market is a dynamic picture showing the complex interconnectivity of diverse elements affecting the market. The worldwide market for restaurant POS systems ended in 2022 at a remarkable USD 1138.89 million, predicted by various projections to grow to USD 2208.52 million by the end of 2028. A healthy compound annual growth rate (CAGR) in the restaurant sector was detected and aided by the POS software industry. There are two types of software: on-premise and cloud-based, with the cloud-based type being only recently developed and rapidly gaining acceptance at the expense of the first one.

Component Insights

Influencing Presence of Hardware:

The space finds its rightful place at the center stage of the segment, which commands 48% of the market share in 2022. Outside the core POS system or being incorporated as an integral part of a multi-purpose POS system are hardware components of a restaurant POS system that act as a standalone unit or as an all-in-one device. Vendors show willingness to invest in solutions that can solve the coexistence difficulties of a single system with numerous other systems. The integration process with the POS system reduces operational complexity and offers vendors the flexibility to adapt their POS solutions based on specific requirements.

Robust Revolution of Software:

On the other hand, software would be the front-runner and account for over 41% of the market share, with a forecast for a steady increase between 2023 and 2030. This tide is pushed forward by rising demand for tailor-made POS solutions to satisfy different functional areas of various industries. The rise of cloud computing amidst a steady flow of events has been commanding the widespread adoption of SaaS platform-based POS systems. Cloud solutions with points of sale (POS) terminals for reliable data backup and recovery features are also available. The brilliance of software is increased by the convenience of service updates in discrepancy when the hardware needs maintenance and repair.

Market analysis:

A push promoting restaurant POS software growth is the increasing number of readiness to pay with credit cards. The growth in mobile POS payment systems is the indirect driving force behind the demand for advanced POS software solutions.

Market Conditions Analysis:

Indeed, the notions are countered by issues such as cybersecurity. Cybercrooks POS software targets data breaches and raises questions about data safety. Verizon’s 2019 Breach Investigation Report stated that POS hacks and data leaks were causing security breaches in the hospitality and food sectors. It challenges POS providers negatively, showing a lack of trust in the company, an outbreak on the brand, and may end up in court.

Dominant Trail Of Software:

The POS software predicted to grab over 41% of the market share with great potential for growth from 2023 to 2030 indicates a clear polarization of the market. It is remarkably driven by swiping incremental demand for made-to-order POS solutions, which are niche-centered on particular business needs. The innovations brought by cloud computing in terms of SaaS and platform-based point-of-sale (POS) system adoption are beyond forecast. Such cloud solutions are so functional that POS terminals and peripherals have robust data backup and restore functionalities flawlessly integrated. This feature also guarantees quick upgrades, which satisfy the need for the hardware segment (maintenance services and repair).

Market Trend Analysis:

A vital reason pushing restaurant POS software growth to an extent is the growth in the use of card-based transactions. This phenomenon gives rise to mobile POS payments. Users are aligning with the existing network, creating buyer interest in surprisingly sophisticated POS software programs.

Market Restraints Analysis:

The POS software falsifies cybercriminals to conduct data breaches and hack details of clients. Based on Verizon’s Data Breach Investigation Report 2019, POS violations and data leaks add up to a considerable portion of the security in the hospitality sector. It creates a dilemma for POS systems that might cause a crisis of trust from business owners, a loss of brand image, and legal implications.

Cloud Dominance:

The cloud platform model is decisively prioritized and guarantees an excess of 53% market share by 2022. Moreover, this deployment model will witness the highest compound annual growth rate (CAGR) between 2023 and 2030. The cost-efficiency and high return on investment (ROI) stemming from cloud-based solutions help cloud-based POS solutions become more popular. Cloud deployment disposes the need for localized data centers and specialist professionals who can simplify data management activities. The role of cloud-based POS solutions to simplify business operations will be highlighted further. Inadequate connectivity may appear as a sizable threat to companies that might suffer transaction failures and disruptions in crucial procedures.

On-Premise Implementation Enduring Demand:

It remains a main market segment and is predicted to grow quite nicely in the future, according to the 2022 data (over 46%) so far. Most big restaurants that supervise Overlook utilize on-premises deployment because all the private and sensitive customer data would be resident within their firewall. The purpose here is to provide the opportunity to have such POS systems without internet dependency. Small and middle-scale restaurants are more proximate to cloud deployment, prompted by its economic advantages and budget compatibility.

FSR Segment Dominance:

Although the FSR segment ensures a luxurious dining experience, it will account for only 37% of the market in 2022. The FSR group naturally evolves—hard to believe—yet it successfully implements innovations in the processing of payments, taking orders, managing inventory, and customer engagement with the help of technology. POS solutions have sharpened these POS terminals into full-blown management platforms dealing with catering not only to payment methods but also such additional services as ordering, gift card processing, loyalty programs, and customer relationship management (CRM).

Enhanced Customer Experience and Efficiency:

The industry becomes more competitive, and supply chain management and order quality emerge as more critical. The POS software is the key player in the customer service ERA by uplifting the consumption experience of the customer, providing exact transactions, and, essentially, saving a lot of time. Quick Service Restaurants (QSRs), like the chains KFC and Pizza Hut, are seen as the plays to the cards for the efficiency of the payment process using the restaurant POS software.

QSR Market Presence:

The retention of the QSR food service (QSR) segment is expected 27% rise at the end of 2022. Point-of-sale (POS) systems gear up QSR that is driven, on foot, or picked up. These terminals efficiently operate through online and offline channels, process payments, generate sales reporting, and sales records and working hours for employees. The expansion of the market is very much attracted to the fact that many systems have a nice assortment of features essential for QSRs to run successfully.

Region Overview:

North America is accounted as a region that has the best opportunity for market growth and exhibits the highest growth rate among all regions. Thus, not only the regional importance but also the technological readiness of the continent presented.

Segmentation Overview:

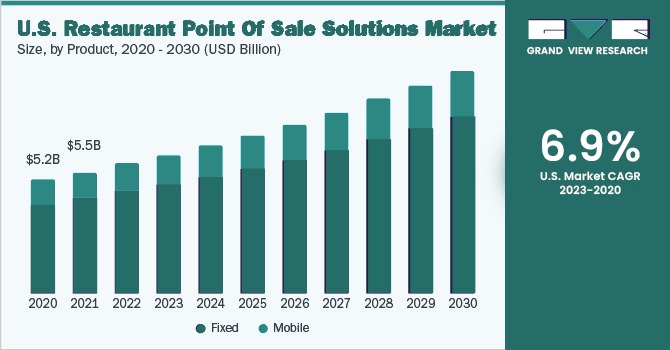

Under distinctive product types, the cloud-based segment is expected to lead the market next year and contribute to the share by 2027. It shows that the sector attempts to be adaptive to the needs of growing and scaling cloud services.

Application Overview:

From the point of view of application, the full-service restaurant (FSR) segment took the leading position and occupied the maximum share from 2017 to 2022, which confirms that it is the trendiest segment. Herein lies a call for the importance of POS software as it contributes to the smooth running of operations in turn-key dining facilities.

Market Report Coverage:

The Restaurant POS Software provides a complete analysis of the market in terms of introduction, segments, status, trends, opportunities, challenges, industry chain, competitive analysis, company profiles, trade estimation, and statistics. It consists of in-depth and comprehensive investigations by processing qualitative and quantitative data from authentic sources, such as primary and secondary sources. The report has five years of the historical period, from 2018 to 2022, followed by the forecast period within the next five years, from 2023 to 2028. Tables, graphs, pie charts, and diagrams are powerful tools for communicating numeric data and an essential resource for effective decision-making.

The global market for restaurant POS software has shown a tendency to broaden technological development, consumer preferences, and some new requirements of the restaurant industry. Therefore, the causes of the market growth related to each key player along with the development of cybersecurity, which in the future will provide suitable options for the business. The U.S. restaurant point-of-sale solutions market as a dynamic and complex domain influenced by the interactions between hardware and software components, distribution channels, and end-users. Technology, which keeps changing the marketplace, directs the growth, that is, in response to such customized demands, increased application of cloud services, and the ever-changing requirements of full-service and quick-service restaurant establishments.